Data Point of the Week is AR Insider’s dive into the latest spatial computing figures. It includes data points, along with narrative insights and takeaways. For an indexed collection of data and reports, subscribe to ARtillery Pro.

One of the ongoing challenges in market sizing is to piece together clues to extrapolate things like unit sales and software revenues. In mature markets like smartphones, hardware players disclose figures — especially if public — but it’s a lot quieter on the early-stage front.

That’s the case with VR, which becomes an exercise in gathering hints in perpetual market-sizing mode. Sometimes there are gifts like Sony’s frequent disclosures while boasting PSVR sales. Otherwise, it’s about detective work and talking to as many industry insiders as possible.

But there are also valuable market signals and gut checks along the way. For example, last week we estimated holiday Oculus Quest sales, and did a similar cumulative sales estimate in September. Both exercises extrapolated hardware units based on software revenue disclosures.

Due Diligence

The latest diligence along these lines comes from the always insightful and venerable Tipatat Chennavasin at the Venture Reality Fund. As we’ve said, focused XR investors like Tipatat have unique perspective that flows from the diligence and rigor they need to put venture dollars in play.

The Venture Reality Fund specifically focuses on early-stage VR, AR, and AI companies. Through that, Chennavasin has looked at 5,000 companies in these sectors and has invested in 35, including the companies behind top VR titles like Beat Saber, Rec Room, and Job Simulator.

For this market-sizing exercise, Chennavasin used game review volume as a correlative factor to software sales. As we’ve done in the above exercises, software sales can then be used as a stepping stone to hardware sales using known variables like software spend per user (ARPU).

But putting hardware aside, software sales are a key metric Chennavasin asserts. Segmenting software revenue by platform can inform decisions about where the biggest addressable market lies. This can be a function of hardware installed base but also platform reach.

“People tend to focus on headsets sales, he wrote in a RoadtoVR article, “which remains largely speculative as only Sony ever publicly discloses numbers. Even so, a far more important data point we do have is software sales—this is a key metric for differentiating between a platform and a product. Because even if Oculus sold 100 million VR headsets, but no third-party developer could make $1 million in revenue, then it wouldn’t be a platform; it would be a successful product for Oculus, but it wouldn’t be a viable platform to create an ecosystem of successful developers.”

The Findings

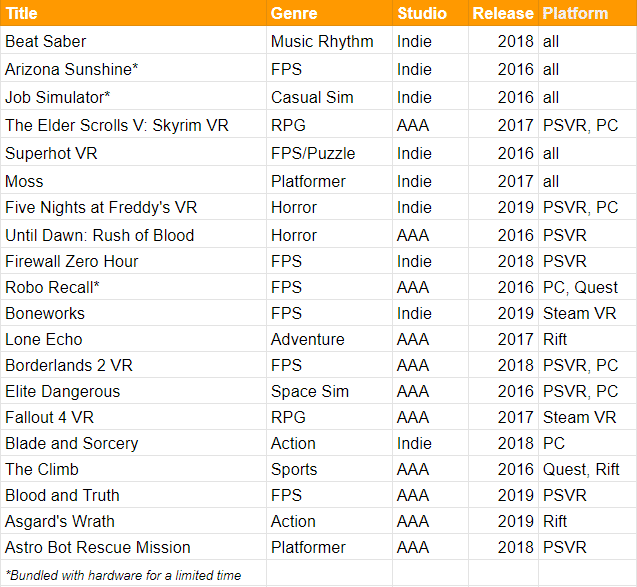

Chennavasin’s calculations revealed that more than 100 VR titles exceeded $1 million in revenue, with the top-grossing titles exceeding $10 million (full list below). This and other factors caused aggregate VR software revenues to triple year-over-year during 2019.

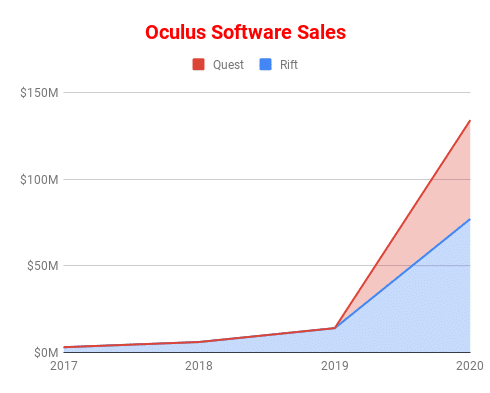

Drilling down to different platforms, calculations indicate that Oculus had a 10x jump in software sales in 2019. This is credited to hit games like Beat Saber, but moreover to the launch of Quest. Its share of Oculus software revenues grew from 20 percent in September to 40 percent today.

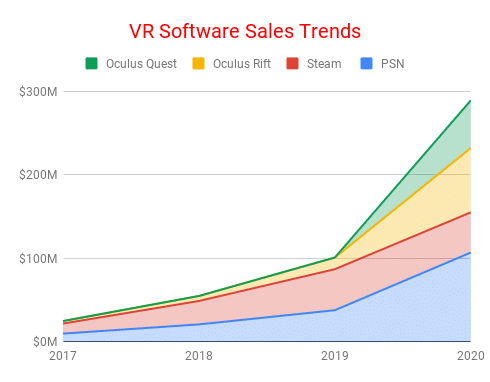

Panning back to the rest of the market reveals a similar inflection. Total VR software revenue is estimated to have trippled in 2019 to $300 million. This is due to the same factors as above — Oculus Quest’s market impact and a few breakout games like Beat Saber and Asgard’s Wrath.

In terms of platform comparisons, Oculus has better software monetization on a per headset level. Sony’s 5 million in-market headsets drove $110 million in 2019 software ($22 ARPU). Oculus smaller installed base (we’ve estimated 470,000) drove $60 million ($127 ARPU).

Native Advantage

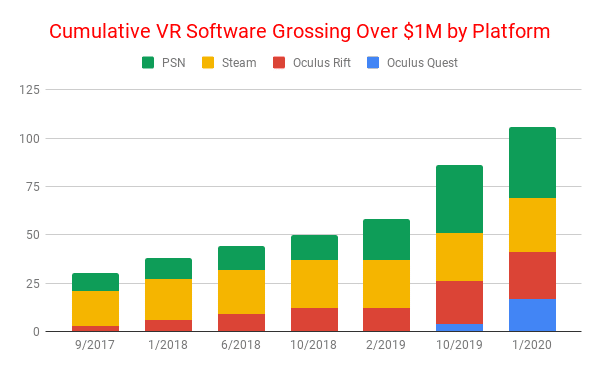

Beyond aggregate revenue across platforms, it’s also important to look at hits potential within each platform. In other words, how many games within each platform have achieved revenues of $1 million or greater — a key threshold to define a marketplace’s potential for meaningful profits.

On that measure, more than 100 titles reached $1 million in 2019, up from 40 in 2017, which is a strong confidence signal in the aggregate. As for platform segmentation, the story is similar to the above: PSVR leads but Quest outperforms on a per-capita basis (literally, as capita means head).

Other strategic takeaways include the fact that the majority of these hits weren’t made by AAA studios, the exemplar being Beat Games. This demonstrates that incumbents don’t have an advantage in VR, and speaks to smaller studios’ agility, speed to market and native VR focus.

The latter aligns with a separate takeaway in Chennavasin’s findings. A common factor among revenue leaders is natively-built VR titles as opposed to PC ports and IP-driven launches (typical big-studio fare). This aligns with the standard lesson about native design with new platforms.

Confidence Signals

Altogether, there are lots of takeaways for trend analysis, VR-sector confidence signals, and strategic guidance for developers. The figures are valuable for us as market-sizing inputs, but more importantly, they can help inform VR developers where to place their chips.

As a confidence signal on a macro level, it’s worth noting that Beat Saber’s $20 million in first-year revenue exceeds Angry Birds’ $7.15 in its first year. Mobile gaming’s skepticism at the time mirrors that of VR today, which isn’t conclusive of anything but is a strong sign for VR growth.

“When looking for a new platform, it’s important to note when the first third-party developer makes $1 million. Three and a half years into consumer VR, there are other 100 titles that have made over $1 million, and amazingly, a top VR title can gross over $60 million in two years with no signs of slowing down. And this is with an estimated install base of 10 million units that is now growing at an accelerated pace. It’s exciting to see the beginnings of a new platform and seeing indies and startups succeed anew. At this pace, we should easily see the first VR title reach the $100 million milestone by this time next year and that will show when VR graduates from an emerging platform to one that everyone should pay attention to.”

For deeper XR data and intelligence, join ARtillery PRO and subscribe to the free AR Insider Weekly newsletter.

Disclosure: AR Insider has no financial stake in the companies mentioned in this post, nor received payment for its production. Disclosure and ethics policy can be seen here.