Tim Merel

Apple is seen by some as critical to the future of augmented reality, despite limited traction for ARKit so far and its absence from smartglasses (again, so far). Yet Facebook, Microsoft and others are arguably more important to where the market is today.

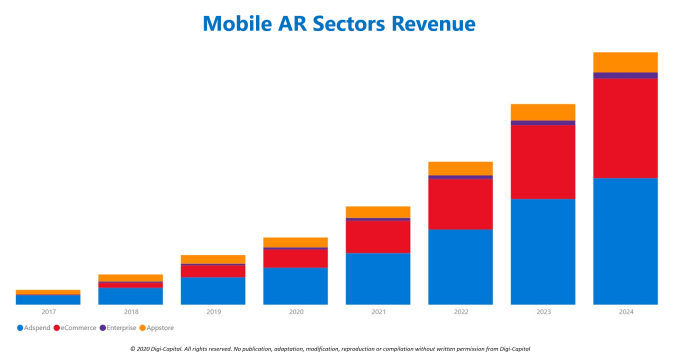

All of this could see the augmented reality market growing from an active installed base approaching 900 million and over $8 billion revenue in 2019, to an augmented reality forecast over two and a half billion active installed base and nearly $60 billion revenue by 2024.

Facebook: The messaging play

Facebook has talked about its long-term potential to launch smartglasses, but in 2020, its primary presence in the AR market is as a mobile AR platform (note: Facebook is also a VR market leader with Oculus). Although there are other ways to define them, mobile AR platforms can be thought of as three broad types:

- messaging-based (e.g. Facebook Messenger, Instagram, TikTok, Snapchat, Line)

- OS-based (e.g. Apple ARKit, Google ARCore)

- web-based (e.g. 8th Wall, Torch, others)

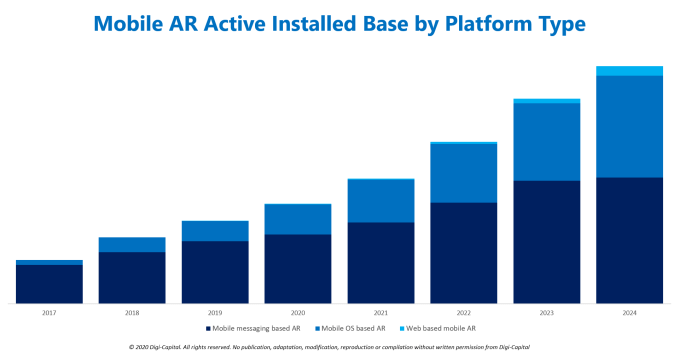

In terms of active installed bases, messaging-based mobile AR is forecast to grow from over 600 million in 2019 to over 1.3 billion by 2024, OS-based mobile AR from over 200 million in 2019 to over 1 billion by 2024, followed by web-based mobile AR (at a much higher growth rate). This could see all mobile AR platforms combined active installed base grow from less than 900 million in 2019 to over 2.5 billion in five years. (Note: total figures for active installed base types inherently involve double-counting, exaggerating total figures due to users active on more than one platform. However, this enables direct comparison between different platform types and platforms.)

Source: Digi-Capital AR/VR Analytics PlatformMessaging-based mobile AR is the largest platform type today, as well as in long-term forecasts. Facebook’s mobile AR filters and lenses on Messenger and Instagram make it the largest company in the space, even with leadership from Snap and others. Yet, OS-based mobile AR platforms ARKit and ARCore (Google Play) could see the largest single-platform active installed bases by 2024.

Mobile AR software’s installed base and commercial dynamics look like a variant of mobile, which plays to Facebook’s strengths. Advertising could be mobile AR’s biggest short and long-term revenue stream, making it critical to an advertising-driven company like Facebook. It’s worth noting that a lot of this ad spend is going towards traditional ad units viewed around user-generated mobile AR content (i.e. filters and lenses on messaging platforms), rather than just mobile AR ad units. This does not mean that sponsored mobile AR filters and lenses are not a significant part of the mix going forward.

Apple: The integrated consumer play

As Digi-Capital has said since 2016, only Tim Cook and his inner circle really know what Apple is going to do in AR before they do it. This was proven in 2017 when Apple caught many (including us) by surprise with the launch of ARKit. The same thing happened in 2019 when Apple added a triple-camera system to the back of the iPhone 11 Pro, instead of the rear-facing depth sensor we anticipated. So where in 2017 we fundamentally revised our forecasts post-ARKit, in 2020 we’ve done the same thing based on a revised view of Apple’s potential roadmap.

Smartglasses have to deliver on five major challenges before they can become mass-market consumer devices: (1) hero device (i.e. an Apple-quality device, whether made by Apple or someone else), (2) all-day battery life, (3) mobile connectivity, (4) app ecosystem and (5) price. While most attention is paid to what that hero device will look like and when it will get here, two of the other challenges are particularly hard to solve.

Until a major breakthrough in battery technology or device efficiency, a lightweight pair of standalone AR smartglasses doing heavy-duty AR is hard to power all day without a battery pack or hot-swappable batteries (fine for enterprise users, a harder sell for consumers). This is a non-trivial problem. Plus, it’s a major risk for the developer ecosystem to invest heavily in building apps for new platforms until the installed base reaches scale. It’s the chicken-and-egg problem that all new tech platforms face. Mobile-tethered smartglasses offer a potential solution to both.

Sharing processing, display and sensors across smartphones and tethered smartglasses gives you two batteries, each powering fewer individual systems. If they’re connected by a cable, this could give battery life a healthy bump. But if the tether is wireless (like Apple’s Watch and AirPods), communication between devices takes back some of the benefits.

While Digi-Capital’s long-term forecast of Apple’s roadmap proved accurate through 2018, our forecast of Apple adding a rear depth sensor to its iPhones in late 2019 did not happen, as discussed. Digi-Capital considers this a key milestone on the roadmap toward Apple launching smartphone-tethered smartglasses, such as an iPhone peripheral, particularly as a bridging step for developing its AR app ecosystem. Again, only Tim Cook and friends know if this will be added in 2020 (if not, forecasts could be revised).

So together with unconfirmed reports of Apple delaying its smartglasses launch, Digi-Capital has pushed back its base case forecast of Apple launching smartphone-tethered smartglasses by two years from late 2020 to late 2022. This results in significant knock-on effects for the smartglasses market as a whole in the medium term. Yet if Apple does launch in this time frame, it could become the catalyst for the consumer smartglasses market (together with Samsung and others). That could also have positive impacts for the enterprise market due to bring-your-own-device (BYOD) demand.

Yet mobile-tethered smartglasses are peripherals to, not replacements for, smartphones. This means that users would need to pay for, charge and carry at least two devices. This additional inconvenience and cost could limit consumer smartglasses’ installed base from Apple — if and when it launches — and others to the low tens of millions of units by 2024.

Microsoft: The enterprise play

Much of Microsoft’s DNA is in enterprise, whether via its Office or cloud-based businesses. Apart from Xbox, a large part of Microsoft’s revenue is enterprise-driven. So it’s not surprising that Microsoft focused HoloLens on enterprise, largely bypassing the AR consumer market and mobile AR (apart from Minecraft).

HoloLens’ price ($3,500 upfront or $125 per month), form factor (1.25 lbs, 52° field of view), three-hour battery life, app ecosystem (first and third-party enterprise apps) and connectivity (Wi-Fi-only) have worked for it in the enterprise market so far. The best example is Microsoft’s $480 million 100,000 unit HoloLens 2 contract with the U.S. military.

However, the enterprise smartglasses market could still remain in the hundreds of thousands of units through 2021, not reaching millions of units until 2024. This is partly because enterprise smartglasses are great for a specific range of tasks but have yet to prove themselves as a comprehensive enterprise platform. Enterprise buyers also price compare smartglasses with cheaper productivity tools (i.e. PCs and mobiles) for many use cases.

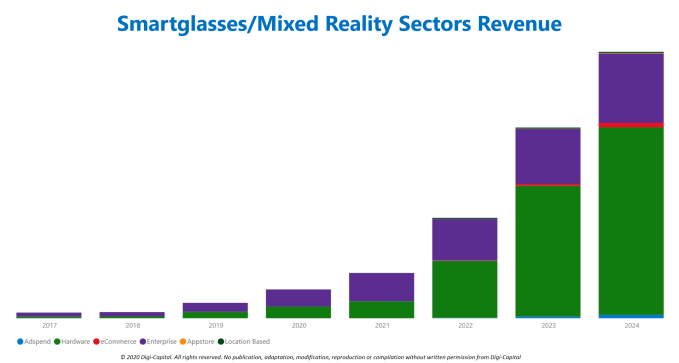

Over the next five years, smartglasses revenue could continue to be driven by hardware sales and enterprise software/services (ex-hardware). In the consumer market, location-based entertainment, e-commerce sales, ad spend and apps (IAP, premium) revenue could accelerate in 2022, if Apple (and others) gain traction. However, unit economics and an installed base in the tens of millions might still see smartglasses consumer software revenue at a relatively low level through 2024.

What does this mean for the future of AR?

Ad spend could remain the largest revenue driver for AR through 2024, driven by messaging-based mobile AR’s active installed base. This is great for Facebook. If Apple launches smartphone-tethered smartglasses in late 2022, it could drive hardware sales to become AR’s second-largest revenue stream through 2024. This could be followed by mobile AR-focused e-commerce, which saves a discussion of Amazon and Alibaba for another day. AR enterprise software/services (ex-hardware) revenue also looks set to grow over the next five years, playing to Microsoft’s strengths. Lastly, at a lower level, app store IAP/premium revenues (games, non-games) and location-based entertainment round out the mix.

So Apple (if it enters), Facebook and Microsoft could all be part of the future of AR. But they won’t be alone.

(Note: platform players such as Google, Snapchat, ByteDance, Samsung, Magic Leap and others are not referenced specifically in this analysis but are included in Digi-Capital’s Augmented/Virtual Reality Report Q1 2020 and AR/VR Analytics Platform. Whether using the above strategies, variations or something completely different, they could all have a significant impact on market growth.)

Comment