Rocio Wu

While some U.S. investors might have taken comfort from China’s rebound, we still find ourselves in the early innings of this period of uncertainty.

Some epidemiologists have estimated that COVID-19 cases will peak in April, but PitchBook reports that dealmaking was down -26% in March, compared to February’s weekly average. The decline is likely to continue in coming weeks — many of the deals that closed last month were initiated before the pandemic, and there is a lag between when deals are made and when they are announced.

However, there’s still hope. A recent report concluded that because valuations are lower and there’s less competition for deals, “the best-performing vintages tend to be those that invest at the nadir of a downturn and into the early stage of recovery.” There are countless examples from the 2008 recession, including many highly valued VC-backed businesses such as WhatsApp, Venmo, Groupon, Uber, Slack and Square. Other early-stage VCs seem to have arrived at a similar conclusion.

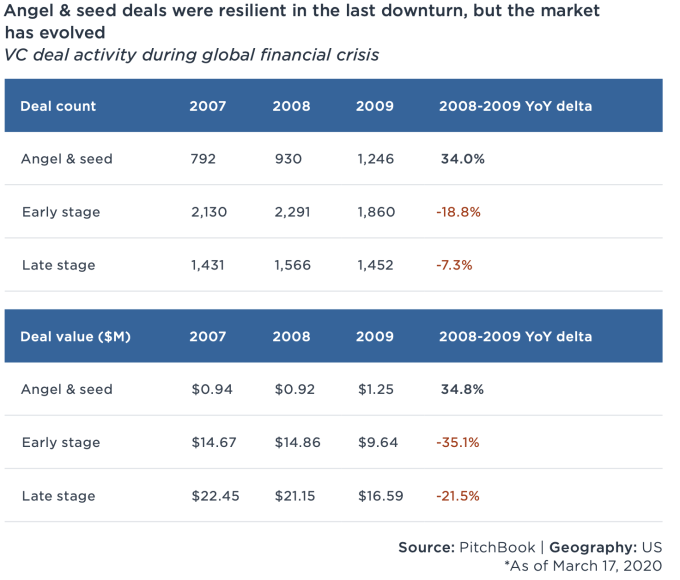

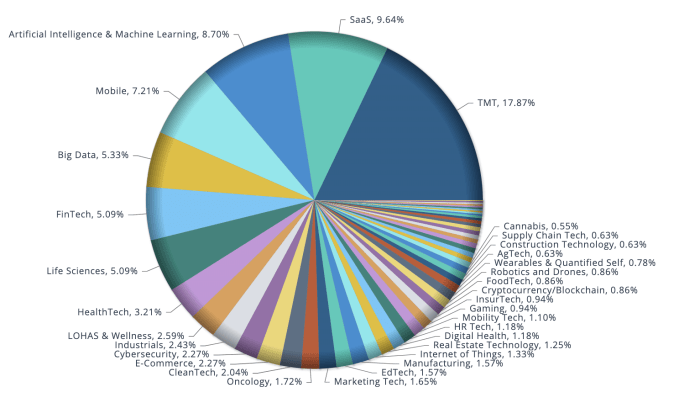

Also, early-stage investing seems more resilient. During the last recession, angel and seed activity increased 34% as interest in the stage boomed during a period of prolonged growth.

Furthermore, there is still capital to be deployed in categories that interested investors before the pandemic, which may set the new order in a post-COVID-19 world. According to data provider Preqin Ltd., VC dry powder rose for a seventh consecutive year to roughly $276 billion in 2019, and another $21 billion were raised last quarter. And looking at the deals on the early-stage side that were made year to date, especially in March, the vertical categories that garnered the most funding were enterprise SaaS, fintech, life sciences, healthcare IT, edtech and cybersecurity.

That said, if VCs have the capital to deploy and are able to overcome the obstacle of “having never met in person,” here are six investment trends that could emerge when the pandemic is over.

1. Future of work: promoting intimacy and trust

As efforts to stop the spread of COVID-19 forces people to work remotely, tools that help them stay connected and productive are booming. Remote is here to stay, but the benefits of remote work come at a cost: communication can be strained, collaboration hampered and the opportunity for serendipitous moments reduced.

- Intimate

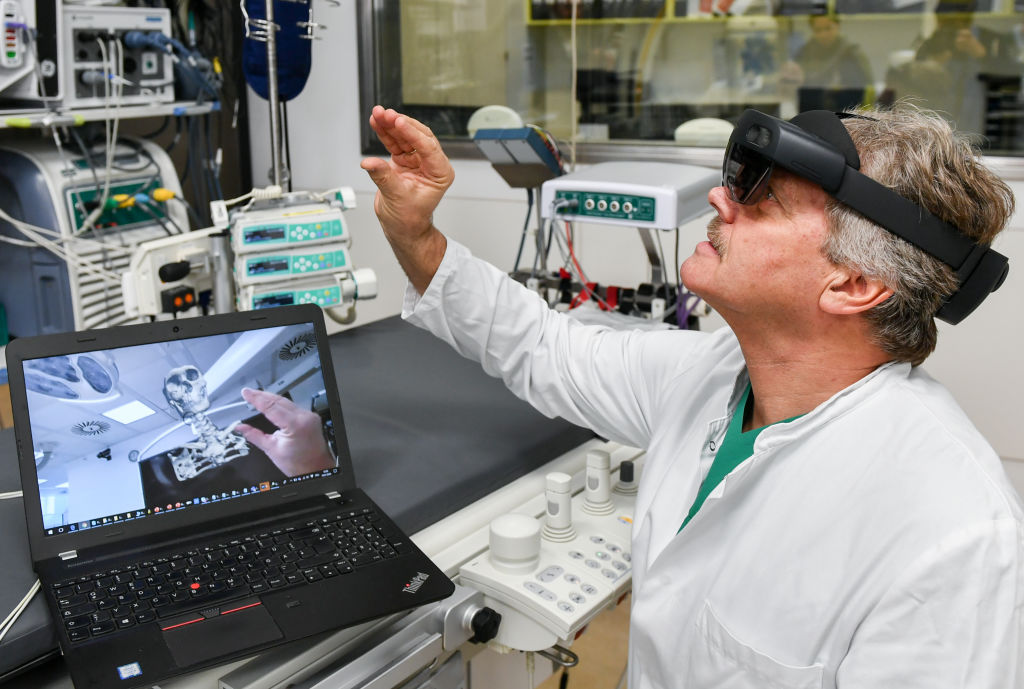

Most video conference tools still seem like inferior substitutes for in-person meetings, but with advances in augmented reality (AR) and virtual reality (VR), maybe they can give us a more intimate environment.

Apple, for example, faces a unique set of challenges because of its secretive culture and dependence on overseas manufacturing. Its workers require more physical interaction to touch and view parts in-person, so promoting interaction between cross-functional teams could help integrate hardware and software more seamlessly. Today, Apple resorts to tracing shapes in the air to describe components, relying on grainy photos to troubleshoot problems on factory lines and taking/sharing photos, which can (and has) lead to product leaks.

Imagine, for example, a meeting with holographic telepresence where colleagues can remote-manipulate AR overlays of component or designs, or virtually repair a malfunctioning factory component. Spatial is already creating shared augmented workplaces for collaboration, and Niantic recently acquired 6D.ai to enable new kinds of planet-scale AR experiences. Google and Microsoft also launched new editions of their respective Glass AR headset and HoloLens 2 last year, both aimed at business use cases. All of these efforts would be made easier with the broader deployment of IoT sensors and edge-computing chips coupled with 5G that fed richer data into work-related AR/VR experiences faster and more reliably, thereby enhancing their functionality.

- Trusted

In a normal world, most meetings and one-on-one exchanges happen offline with little-to-no digital footprint. As COVID-19 pushed most companies to remote work, nearly all interactions can now be tracked and analyzed. Some platforms will assess your organization’s teleconference, phone and email pathways, while others perform audio and video analytics during calls to analyze emotional sentiment and well-being, all great measures that create transparency and help compensate for a lack of physical cues.

However, how should companies manage the data collected and who should own this data and for how long? These are all important questions to answer to gain employee trust and create a psychologically safe work environment. Safeguarding data privacy will be the central pillar in the adoption of future of work tools, and great companies will be those that understand behavioral psychology and make the best policies.

- Integrated

Nowadays, multiple collaboration products live under enterprise roofs. There are just too many applications for different parts of the productivity chain. If you can create a central hub and connect all these applications together seamlessly, that would be most ideal, and it requires coexistence and integration among competitors through APIs, and integration with existing workflows.

Integration also means an integrated life. Nowadays during shelter-in-place, instead of “work from home,” we are more like “bring family to work,” boundaries between work and life are non-existent, not even “blurred.” After the pandemic is over, schools reopen and parents go back to work, how will the future of work tools help us manage work-life balance and lead a more integrated life?

2. Healthcare IT: telemedicine and remote patient monitoring

Telemedicine has been around for nearly two decades, but before the pandemic, it never took off and only one in 10 Americans had tried it, but more providers are offering digital consultations and diagnosis due to increasingly high demand. GoodRx launched its telemedicine marketplace a few weeks ago, which currently compares plans from 98point6, One Medical, Hims, K Health and other telemedicine companies. Telemedicine startups are experiencing a surge in demand, as well; Teladoc recently experienced a spike of 50% week-over-week in patient visit volume and 98point6 saw volume of virtual visits roughly double, raising $43 million last week. The crisis could propel longer-term growth in telehealth as more users become familiar with the technology.

But still, there are a couple of hurdles to overcome on the reimbursement and regulation side. During the pandemic, Centers for Medicare & Medicaid Services (CMS) increased its coverage of telemedicine services for providers, and both state and federal governments are waiving requirements that physicians hold a separate license for each state in which they practice and are paid. Still, it is unclear yet whether existing providers will embrace telemedicine reimbursement when the crisis is over.

In addition to telemedicine, remote patient monitoring (RPM) sensors are also a big trend. The technology can increase care accessibility to low-risk patients, with tools ranging from mobile technologies, wearables and smart home devices. Tech giants are doubling down on healthcare products and services, including Amazon Alexa adding Healthcare skills, Google Assistant’s investment in Aiva Health, health records on iPhone and Apple Watch’s ability to identify early warning signs with inbuilt ECG and fall detection. Wearable sensors would soon track many more aspects of human biology, from galvanic skin response to glucose level. This global health crisis could propel increasing long-term deployment of RPM devices for both prevention and treatment, particularly for those most vulnerable.

3. Robotics and supply chain

As Scott Phoenix, CEO of Vicarious robotics puts it, “the pandemic has definitely moved adoption up the time frame, the world was already heading to robotics and COVID-19 is just accelerating it.”

Working from home will remain much more challenging for industries where human labor is heavily involved, such as manufacturing, agriculture and logistics, etc. You can work remotely via Zoom, but you can’t pick strawberries. Instead of trying to replace labor, perhaps we should think more creatively about how to use technology to supplement and enhance human skills, the way ATMs freed up bank tellers to provide other services and bomb disposal robots keep soldiers safe. In the long term, investments are likely to increase in robots and autonomous technologies that can help maintain business continuity during labor shortages and disruptions.

Another opportunity is supply chain. Warehousing, fulfillment and delivery industries are highly dependent on labor, which generally makes up 60-65% of the total cost of warehouse fulfillment (not including shipping). The current crisis could catalyze long-term investment in new supply-chain technologies as companies seek to diversify value chains and mitigate the risk of future shocks. For instance, it would be tremendously helpful if we could monitor in real-time the journey of each component from manufacturing to delivery. Blockchain-based decentralized ledgers could potentially make it easier to track products across complex logistic journeys and international borders. Also, flexible on-demand warehousing can help retailers and inventory-heavy companies during periods of fluctuating demand as most retailers have adopted lean just-in-time (JIT) inventory management models to help them reduce inventory and save warehousing costs. Slync and Olimp are innovating in these spaces and just closed fundraising in Q1.

4. Cybersecurity

There has been an unfortunate rise in fraud and scams surrounding COVID-19. Bad actors continue to push phishing scams and look for other ways to steal personal information.

As such, the security industry is constantly evolving in response to emerging threats, leading to new innovation opportunities. Enterprises moving to the cloud, workforces accessing core systems from home and consumers transacting more online has exposed vulnerabilities that can potentially be exploited by hackers, from user credentials theft, new phishing attacks, fraudulent transactions and data breaches. Despite that only 43 deals in this sector have closed so far this year compared to 91 deals over the same period in 2019, there are still many opportunities in the cybersecurity space:

- digital identity/KYC

- data access

- cloud security

- fraud detection & prevention

- privacy management

TrustStamp, Okera, Bridgecrew, Robust Intelligence and Manetu are a few that are innovating in each of these categories and just raised new funding in Q1. Also, there is already an industry trend toward consolidation of information security toolchains, and this crisis could accelerate it. Customers want to choose one platform that does it all for the least price.

5. Education = knowledge transfer + social + signaling

As COVID-19 forced schools to move classes to online, education’s traditional delivery model has suddenly been disrupted. While it is helpful that Zoom has enabled the new digital delivery method, students and professors acknowledged that it is a poor substitute for in-person learning experiences.

Online learning has been around for almost a decade, but until now, it has largely failed to disrupt traditional education. Knowledge transfer is part of education, but, there are two other equally important components: social (learn with your peers and from your peers) and signaling (to signal the value of the knowledge acquired for the job market).

Learning will be a lifelong experience and higher education is likely to get modularized. For example, instead of students spending four years on campus, it might be two years on campus, field studies, internships or projects for a year, and back to campus for the final year or semester. These modules can be customized based on each student’s individual need, major and timeline.

Whether online or offline, AI will play an increasing role in terms of a personalized learning experience, helping students know themselves and customizing learning based on each pupil’s habits, progress and outcome. To achieve that, it does require a tremendous amount of data, likely multimodal (e.g. neuro-linguistic programming, computer vision, neuroscience) to get enough input. And only until we can figure out the right policies to ensure data ownership, security and privacy, will we be ready to embrace it.

6. Fintech

The pandemic will also be likely to accelerate demand for insurance claims automation and disease modeling. Inefficiencies in the insurance industry will be exposed as insurers handle significantly more inquiries and claims and auto insurers offer rebates to customers who are unable to drive their cars. It could also be a catalyst to drive AI adoption in claim processing and fraud prevention; insurance industries constantly need to incorporate new disease data into their underwriting models to calculate the potential implications. The unprecedented nature of COVID-19 will spur new innovations in the field. As an example, startup Metabiota enables reinsurers and insurers to accurately quantify complex infectious disease risk.

Digital payments will most likely benefit from the crisis as consumers get increasingly conscious about personal hygiene. Before the pandemic, most people still preferred cash or debit/credit cards for payments, and digital payments were a small factor in the overall payments picture — only 15% and 27% if Gen Z and millennials had added a credit or debit card to a digital wallet. Nowadays, people try to avoid handling cash and touching PIN pads as much as possible. The uptick in digital payments/wallet adoption could make consumers across all age segments more digital-savvy, giving rise to new fintech opportunities.

Closing thoughts

As I wrote previously, the most volatile times are optimal times to participate in early-stage private markets — and even create opportunities for founders who are disciplined, resilient and resourceful.

I used to think successful people were lucky because fewer bad things happened to them. That’s partly true. But successful people also just keep going, turning challenges into lily pads for the next leap forward.

Will China’s coronavirus-related trends shape the future for American VCs?

Comment