The government of India is considering an 18% tax on all bitcoin transactions, according to a new report from the Times of India. It’s not clear whether the proposed goods and services tax (GST) would apply to other cryptocurrencies like ether, the second largest after bitcoin.

The new proposal to tax all bitcoin transactions reportedly comes from the Central Economic Intelligence Bureau (CEIB), an arm of India’s version of the Treasury Department, according to the Times of India. The country’s Supreme Court lifted a ban on the trade of cryptocurrencies just this past March after a prolonged legal battle, but digital money backed by nothing still exists in a gray area.

The new proposal would categorize bitcoin as an “intangible asset” rather than how most cryptocurrency proponents would like to categorize it: as a proper currency. But there are still plenty of skeptics who see cryptocurrencies as nothing more than a convenient way for illegal businesses and money laundering to flourish.

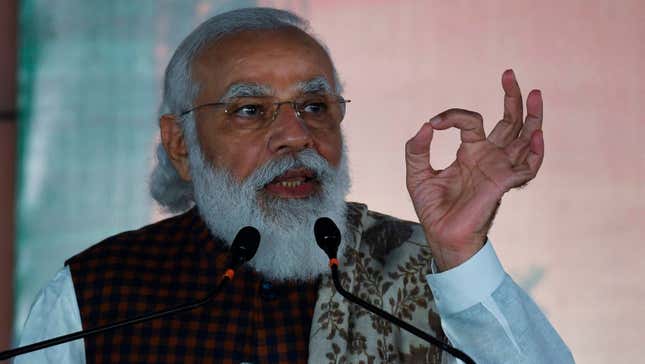

The new tax on bitcoin would bring in an estimated $1 billion per year, according to Finance Magnates. It’s not clear how the GST would be enforced if the Indian government, led by Prime Minister Narenda Modi, decided to go ahead with the proposal.

All of this gets to the heart of how governments are struggling to regulate and tax cryptocurrencies around the world. Is bitcoin a currency or is it a digital asset?

Or, perhaps, is bitcoin just an elaborate Ponzi scheme destined to crash in price as soon as enough suckers take the bait? With bitcoin at record highs, it’s really anyone’s guess.