A common occurrence in the analyst corps this time of year is predictions and projections. Our research arm ARtillery Intelligence got a jump on that process with its December report that looked back at the biggest lessons of 2020….and forward to the biggest predictions for 2021.

This was also the theme of AWE Nite SF‘s January meetup (disclosure: we’re on the AWE Nite SF production team). ARtillery Chief Analyst Mike Boland joined the speaking roster to break down findings from the aforementioned report, and his segment is this week’s featured XR Talk.

Held in Altspace VR, the talk boiled down the top-5 trends and predictions, which are included below through narrative takeaways and embedded video. Let’s dive in…

1. AR Glasses’ 2021 Fate

The question on everybody’s mind is AR glasses…particularly what Apple will end up doing. Many signals indicate that we won’t see Apple AR glasses in 2021, but we’ll see the ball moved forward from other companies like Vuzix which just unveiled its MicroLED smart glasses at CES.

Speaking of which, Vuzix’s new hardware represents a design target we’ll see more of. Instead of bulky headgear that packs graphically intensive AR experiences like Hololens 2, the pendulum will swing towards social wearability as a design target….though that does mean UX tradeoffs.

That brings us back to Apple, as signals indicate it will take this wearability route — at least in V1 — for its smart glasses in 2022 or 2023. Apple needs to shoot for massive markets, and digitally-enhanced sunglasses or corrective eyewear are much larger markets than AR headgear.

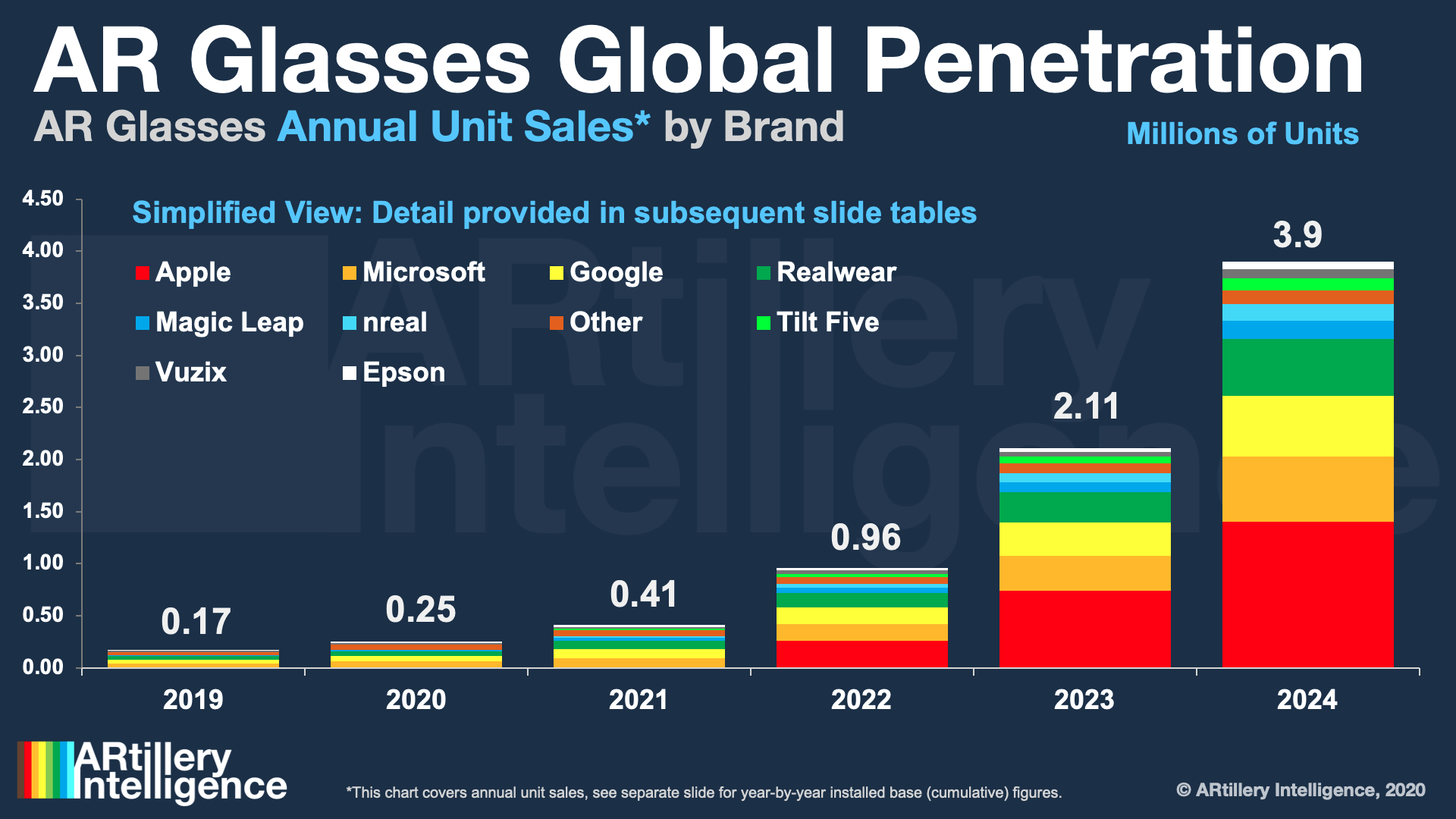

To put some numbers against that, Apple could inflect the market with a classic Apple Halo effect, and ARtillery projects almost 4 million AR glasses sold in 2024 (see below). But to put that in perspective, 4 million units will be dwarfed by the smartphone’s installed base by about 1000 to 1.

2. Mobile AR Reaches 800M Users

Speaking of smartphones, they’re the dominant AR delivery vehicle today. Mobile AR piggybacks on smartphone scale. And though it’s not AR’s fully-actualized version, it’s a compelling step on its evolutionary path that’s creating real revenue today (more on that in the next prediction).

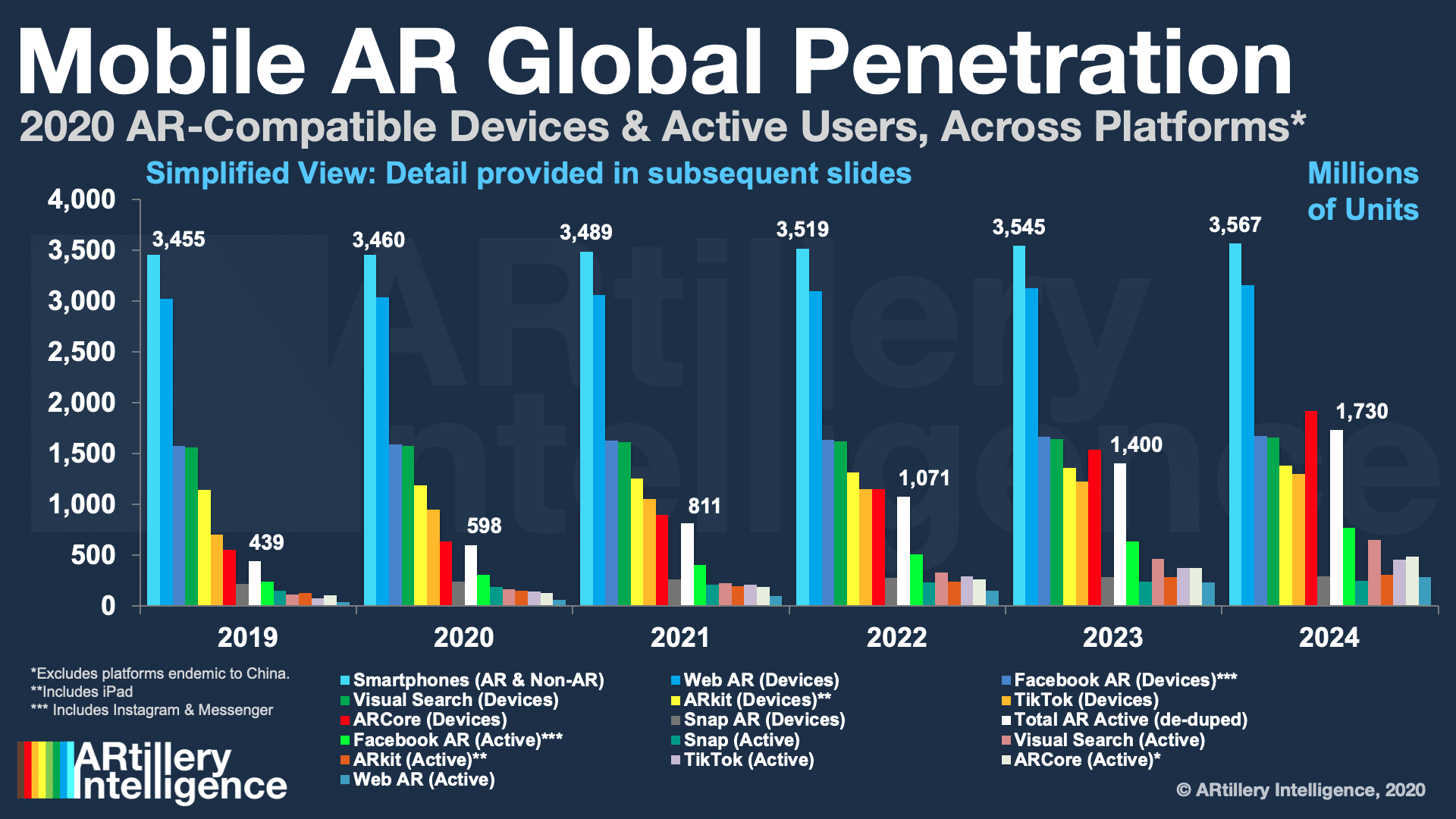

To put some numbers against these claims, there are about 3.4 billion smartphones globally, most of which are compatible with web AR given the work of 8th Wall and others. That’s followed by Facebook’s Spark AR (including Instagram and Messenger) ARKit, ARCore, and Snapchat.

The more important figure isn’t AR compatibility but actual AR users. By adding up and de-duping these platforms, we get an aggregate mobile AR user base of about 600 million users at the end of 2020, growing to more than 800 million by the end of this year and 1.4 billion by 2024.

Other takeaways? Snapchat doesn’t have the greatest device reach but it has the largest portion of its users who are active with AR. Instagram is a sleeping giant as it continues to integrate AR — as is TikTok which could follow Snapchat’s growth if it similarly creates a lens developer platform.

3. AR Ad Revenues Exceed $2 Billion

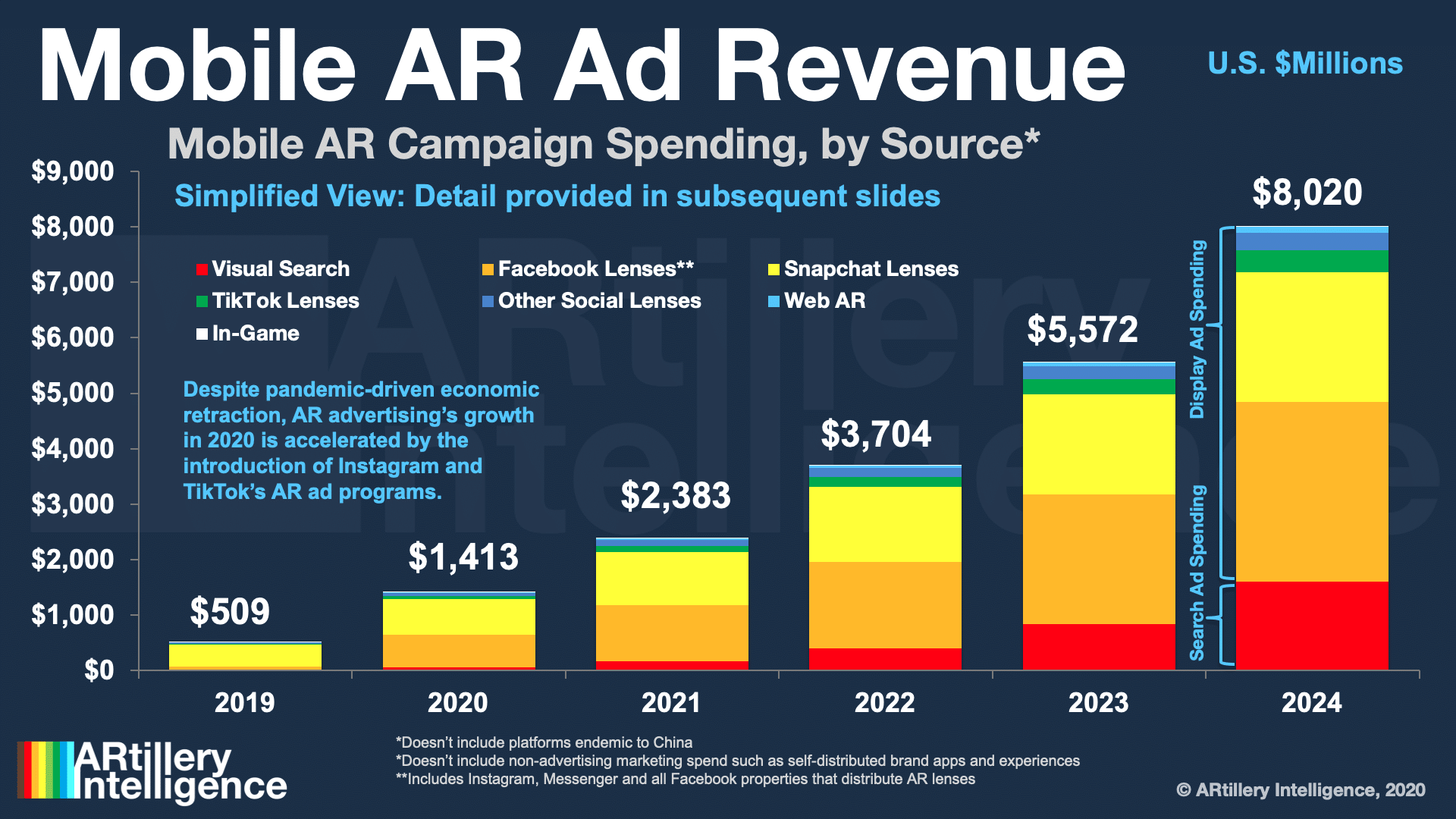

The third prediction stems from mobile AR scale: AR advertising. Spending continues to grow as a function of the high user engagement being established by Snapchat and others to enhance social-sharing. Advertisers have followed those eyeballs and are seeing big results.

AR not only speaks to advertisers’ creative sensibilities in terms of more dimension to show off products, but they’re seeing real campaign performance results and a business case. Metrics include engagement depth, dwell time and direct conversion boosts in eCommerce contexts.

To quantify this growth, ARtillery projects mobile AR advertising to grow from $1.4 billion last year to more than $2.3 billion in 2021. But to address the elephant in the room, economic downturns tend to hit advertising budgets hardest. So would a Covid-inflected recession hurt AR ads?

One counterpoint is that emerging ad formats often benefit from downturns. That happens as brands re-examine their ad mix and shift budget to more performant media. This accelerates digital transformation, which we saw with search in the early 2000’s and social in the early 2010’s.

4. Enterprise AR’s Tipping Point Pushes Back

Everything mentioned so far is in a consumer context, but what about enterprise? It’s actually been one of AR’s revenue bright spots (along with advertising). This adoption is driven by the business case and productivity gains from line-of-site AR guidance in industrial settings.

But it’s not all good news. Though these factors make adoption a no-brainer at the C-suite, buy-in among other stakeholders is a different story. This means the battle for enterprise AR is fought on internal-communications and change-management levels, rather than technology levels.

Due to this organizational inertia and the dreaded “pilot purgatory,” enterprise AR’s tipping point won’t happen in 2021. That day will still come (like it did with enterprise smartphone adoption) as enterprise AR’s momentum overpowers all of the inertia. But it will be a gradual climb.

5. VR: Slow & Steady

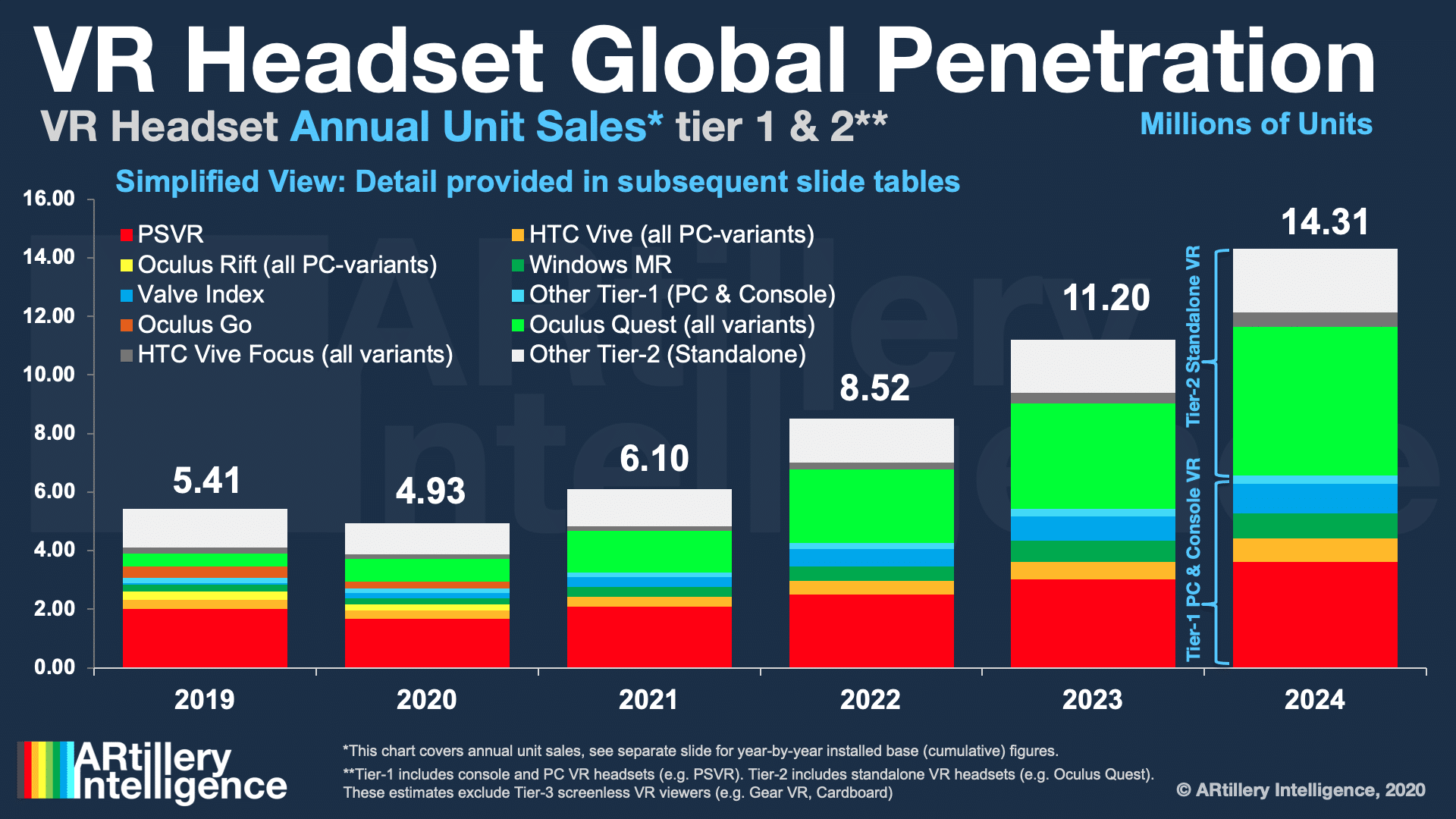

Speaking of “gradual climb,” what about VR? It’s received flack for being a disappointment over the past few years. But VR is doing just fine and is growing at healthy levels. Though it’s not the world-changing revolution it was trumpeted to be in 2016, it doesn’t mean that it’s a bust.

It’s also important to note that 2020 saw some challenges as hardware unit shipments declined about 10 percent year-over-year (see above). That dip was due to both Covid-inflected supply chain impediments, and a decline in consumer spending. But it could have been worse…

Mitigating these losses was Oculus Quest 2’s October launch, which created a strong Q4 surge for VR. More importantly, Facebook beefed up its supply chain after learning from Quest 1 that it underestimated demand in q4 2019. So it has been able to mostly keep up with demand.

This demand will continue into 2021 given Quest 2’s favorable quality/price formula. It helps that Facebook is making long-term investments in building a network effect rather than prioritizing near-term hardware margins. Consumers benefit from that, which will continue to drive sales.

To boil it down to a concrete prediction, ARtillery projects sales for console, PC and standalone VR to grow from just under 5 million units last year to 6.1 million units this year, and 14 million by 2024. During that time, Quest 2 and its future variants will take over as the market share leader.

We’ll pause there and signal the full presentation video below. You can also see the rest of the event’s footage here.