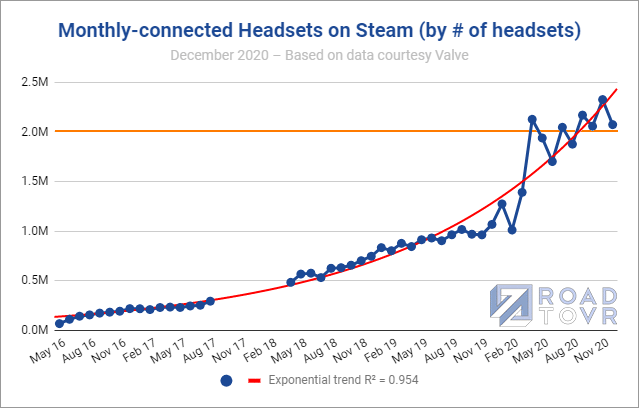

2020 was a big year for VR on Steam with the release of new headsets, Valve’s flagship VR title Half-Life: Alyx, and the Coronavirus pandemic which drove large increases in gaming. These factors combined pushed monthly-connected VR headsets on Steam to pass the 2 million milestone for the first time.

Monthly-connected VR Headsets on Steam

Each month Valve collects info from Steam users to determine some baseline statistics about what kind of hardware and software is used by the platform’s population, and to see how things are changing over time, including the use of VR headsets.

The data shared in the survey represents the number of headsets connected to Steam over a given month, so we call the resulting figure ‘monthly-connected headsets’ for clarity; it’s the closest official figure there is to ‘monthly active VR users’ on Steam, with the caveat that it only tells us how many VR headsets were connected, not how many were actually used.

While Valve’s data is a useful way see which headsets are most popular on Steam, the trend of monthly-connected headsets has always been obfuscated because the data is given exclusively as percentages relative to Steam’s population—which itself is an unstated and constantly fluctuating figure.

To demystify the data Road to VR maintains a model, based on the historical survey data along with official data points directly from Valve and Steam, which aims to correct for Steam’s changing population to estimate the actual count—not the percent—of headsets being used on Steam.

Reviewing the data we can see that the number of monthly-connected headsets on Steam peaked above the 2 million milestone for the first time in April, no doubt thanks to the launch of Half-Life: Alyx, but also due to the onset of the Coronavirus pandemic which drove record numbers of gaming on Steam throughout the year.

Reviewing the data we can see that the number of monthly-connected headsets on Steam peaked above the 2 million milestone for the first time in April, no doubt thanks to the launch of Half-Life: Alyx, but also due to the onset of the Coronavirus pandemic which drove record numbers of gaming on Steam throughout the year.

While the threshold was first crossed in April from the Alyx spike, the last four months of 2020 were consistently above the 2 million mark, with the all-time high now set at 2.3 million in November.

To put the milestone into perspective: it took 40 months for Steam to reach 1 million monthly-connected headsets, but just 7 months after that to reach 2 million. Year-over-year, the number of headsets is up 94%.

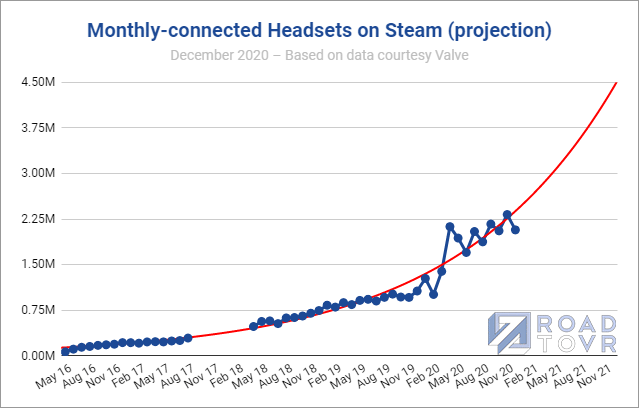

The growth of monthly-connected VR headsets on Steam has stuck fairly close to an exponential curve thus far, with an R² value of 0.954. A naïve projection (simply drawing out the line), suggests the number of monthly-connected headsets could hit 4.5 million by the end of 2021.

Share of VR Headsets on Steam

Share of VR Headsets on Steam

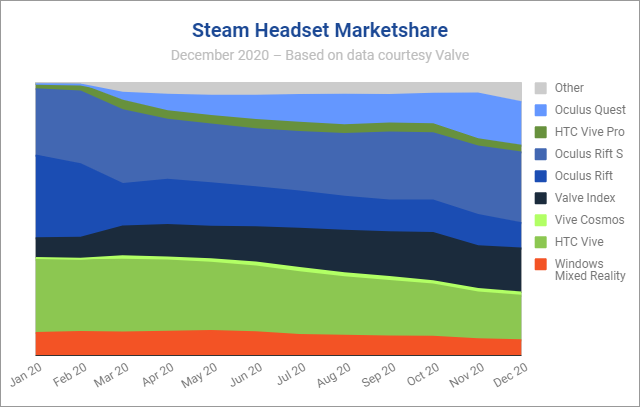

As for the share of headsets on Steam, we can see competition heating up over the course of 2020. Whereas at the start of the year the share was largely dominated by three headsets—Oculus Rift S, Oculus Rift, HTC Vive—by the end of 2020 there’s five headsets vying for the bulk of VR users—the aforementioned three, plus Valve Index and Oculus Quest.

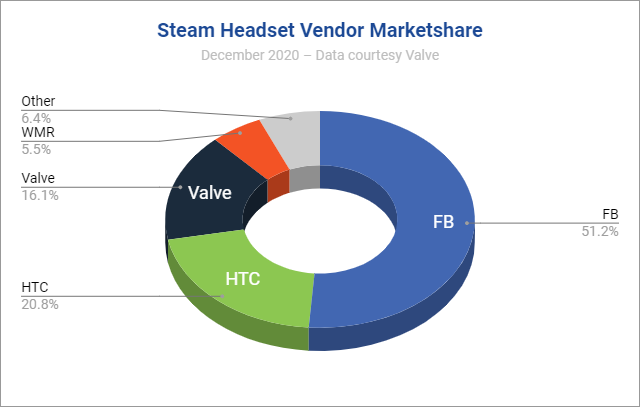

From a vendor standpoint, the growth of Oculus Quest alongside Rift S and Rift has allowed Facebook headsets to suck up just over half the overall share of headsets on Steam. HTC’s headsets still hold onto 20.8% of the market, but have continued to see a slow but steady decline.

From a vendor standpoint, the growth of Oculus Quest alongside Rift S and Rift has allowed Facebook headsets to suck up just over half the overall share of headsets on Steam. HTC’s headsets still hold onto 20.8% of the market, but have continued to see a slow but steady decline.

Windows Mixed Reality, long past its peak share of 11% in mid-2019, now holds just just 5.5% of headsets on the platform. With the launch of HP Reverb G2 at the very end of 2020 however, we could see WMR’s share start to tick back upward.

Windows Mixed Reality, long past its peak share of 11% in mid-2019, now holds just just 5.5% of headsets on the platform. With the launch of HP Reverb G2 at the very end of 2020 however, we could see WMR’s share start to tick back upward.

– – — – –

Beyond these numbers, Valve also shared a handful of interesting statistics about VR usership on Steam in 2020:

- 1.7 million first time VR users were added

- 104 million VR sessions total

- Average VR playtime: 32 minutes (+30% year-over-year)

- VR game revenue increased by 71% (Half-Life: Alyx contributed 39% alone)