Data Point of the Week is AR Insider’s dive into the latest spatial computing figures. It includes data points, along with narrative insights and takeaways. For an indexed collection of data and reports, subscribe to ARtillery Pro.

One of our favorite “wild card” topics is Audio AR. Instead of — or in addition to — its graphical cousin, intelligent audio will augment your perception of the world. That’s music and phone calls today, evolving into more textured audio like navigation and local discovery tomorrow.

But for any of that to happen, the hardware installed base has to come first, as it goes with emerging tech. User comfort levels have to be conditioned — a sobering realization that’s set into the AR glasses sector in recent years. Fortunately for audio AR, AirPods are paving the way.

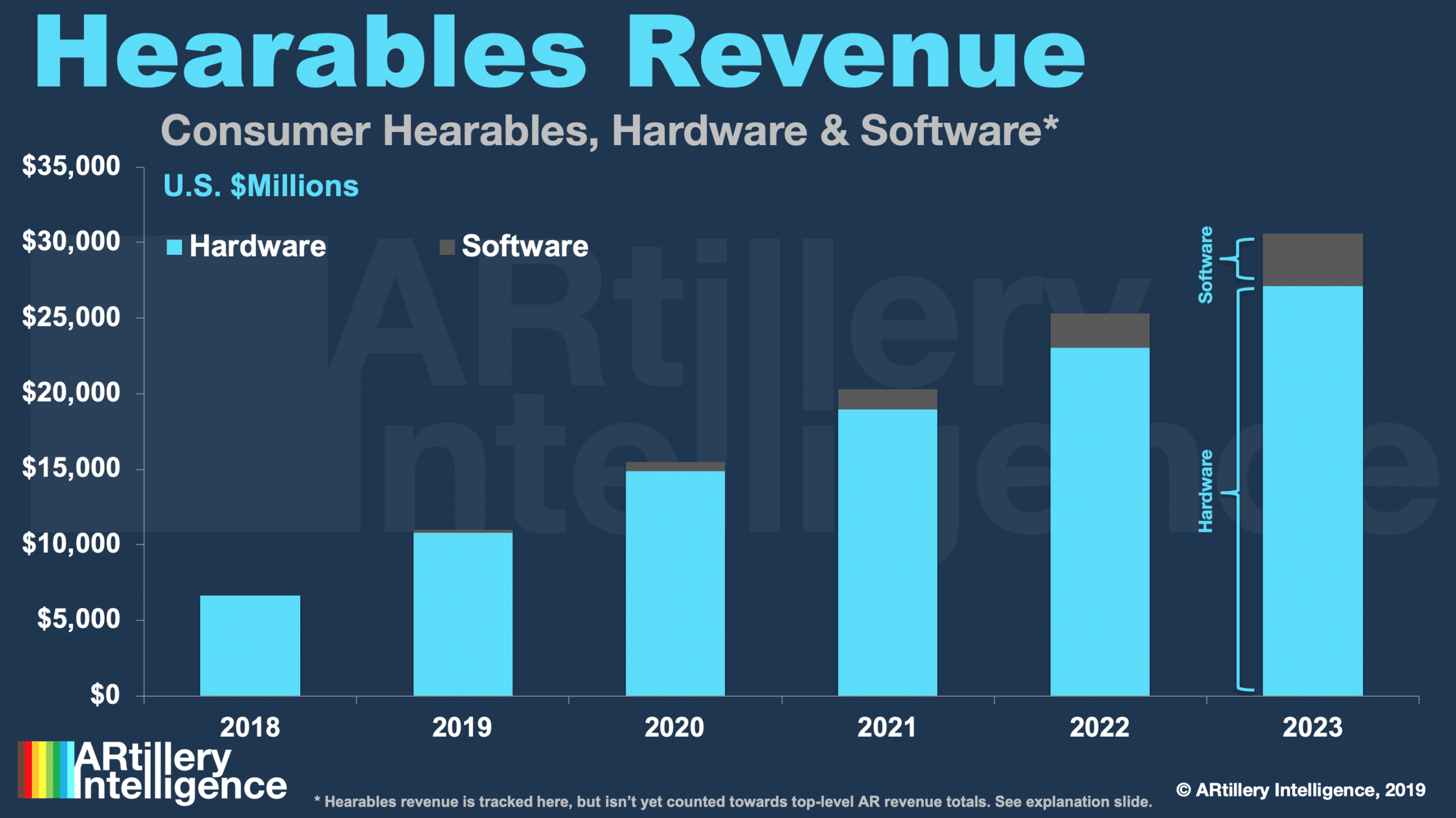

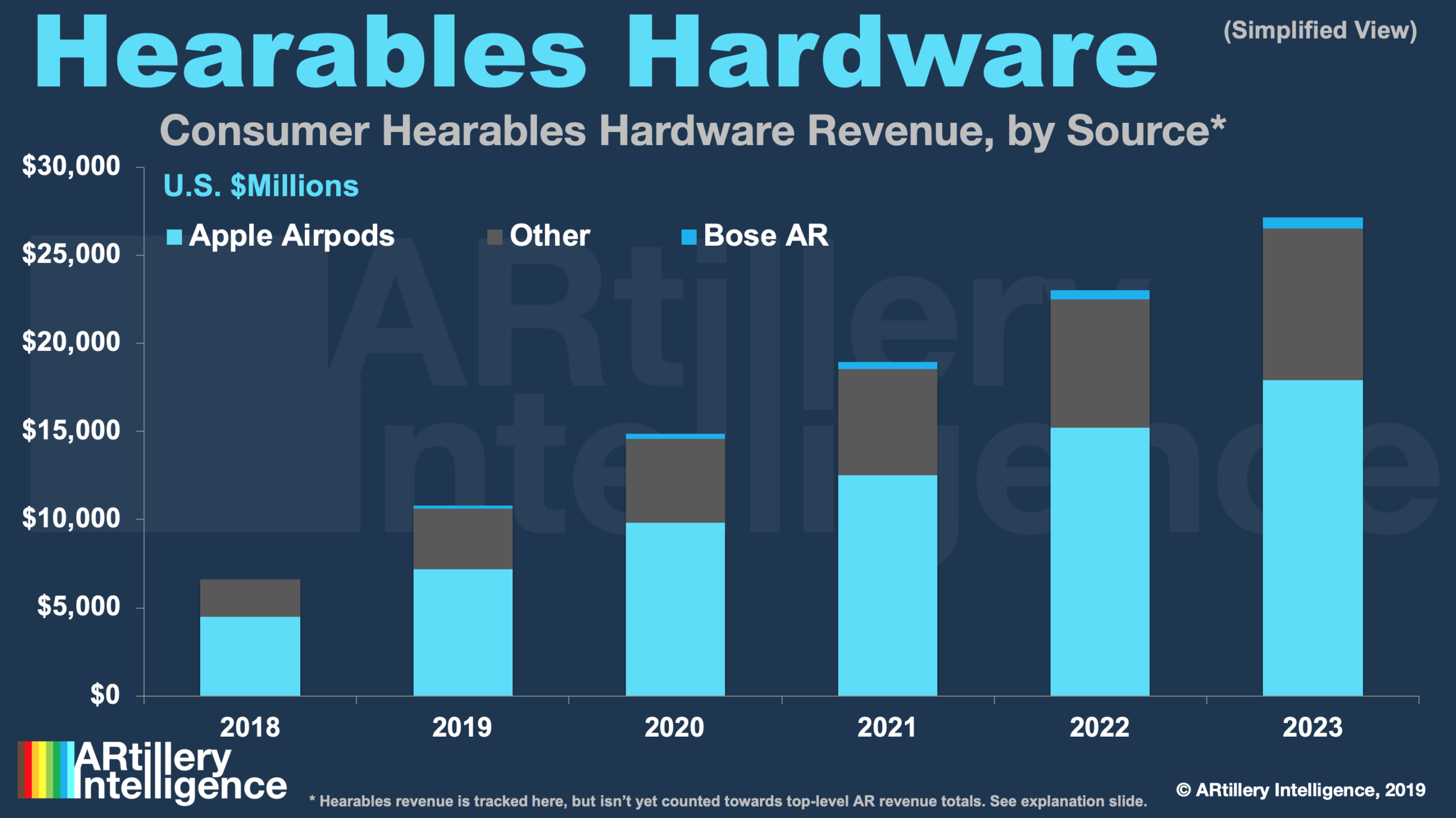

Anecdotally speaking, AirPods are everywhere, and well on the way to achieving that cultural acclimation and acceptance. More empirically speaking, our research arm ARtillery Intelligence pegs the “hearables” market at $10.9 million today, with AirPods as the market share leader.

This correlates to AirPod unit sales of 25.2 million last year, growing to 40.4 million this year and 99.7 million in 2023. As often happens when premium players lead early markets, commodity hardware follows to fills demand gaps down-market, thus accelerating aggregate sales.

More recently, Wedbush Securities supported these figures by signaling that AirPods momentum is going strong. Specifically, it estimated that 3 million AirPods were sold since Black Friday. The firm’s methodology includes Apple store checks, inventory levels and shortages.

Other evidence of AirPods’ momentum traces back to the broader wearables sector, which could inflect in 2020 based on signals we’re tracking. For one, there’s deep-pocketed motivation, including Apple’s need to diversify revenue and counterbalance iPhone sales declines.

To quantify that sense of motivation and urgency, iPhone sales were down 9 percent year-over-year to $33.36 billion in Apple’s Q4 earnings, while wearables were up 54 percent to $6.52 billion. This is analogous to where the iPhone once sat relative to maturing Mac sales.

Meanwhile, others are chasing wearables (including hearables). Google acquired Fitbit to buttresses its WearOS platform with some hardware skin in the game. Amazon launched Bose Frame-like audio glasses and earbuds, followed by Microsoft’s Surface Earbuds.

Then there’s Bose itself. It’s leaning into hearables with its BoseAR platform. In addition to a strong brand, it’s the only player yet to open up a developer platform to scale up the creation of intelligent and sensor-informed audio experiences. And it’s in tune with the acclimation concept.

“Start with something people want,” said Bose’ John Gordon at ARiA. “People want to bring music into their lives, they want to bring sound in, and they will put something on their head to do it. But we wanted to go beyond that… now that we’ve got something on people’s heads, what’s next?”

Whether it’s hearables or other types of wearables like watches, it will serve AR in the long run. For both audio and visual AR outcomes, wearables penetration in general will acclimate mainstream consumers to putting tech on their bodies. And that could raise all AR boats.

For deeper XR data and intelligence, join ARtillery PRO and subscribe to the free AR Insider Weekly newsletter.

Disclosure: AR Insider has no financial stake in the companies mentioned in this post, nor received payment for its production. Disclosure and ethics policy can be seen here.

Header Image Credit: Apple