The virtual reality industry is poised for a transformative five years. While consumer VR equipment is still cost prohibitive for many, location-based ‘VR arcade’ businesses offer a chance for consumers to experience high-end VR equipment without a big up-front investment. And it’s catching on. Especially in China, location-based virtual reality entertainment (LBVRE) is enjoying remarkable traction, where spending on out-of-home entertainment is high. VR developers are increasingly prioritizing this avenue to monetize their content.

Guest Article by Colin McMahon

McMahon is an analyst at Greenlight Insights, the global leader in virtual and augmented market intelligence.

The emergence of the LBVRE sector will benefit VR-first studios, as it is another premium channel to distribute their experiences, much like hollywood studios benefit from movie theaters. For instance, Survios is developing Sprint Vector—an experience tailored for competitive, short-round VR play—which would be ideally suited to a VR arcade setting, where games with short learning curves and quick bursts of fun best fit the timed-play business model. Survios, the world’s top-funded VR content studio, said late last year that they’re in the process of rolling their content out to location-based entertainment centers around the world.

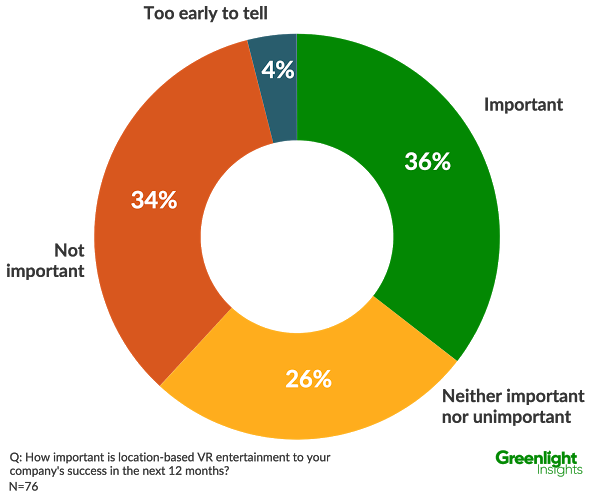

In an effort to better understand how application developers in particular are treating LBVRE as a distinct distribution channel, Greenlight Insights asked more than 400 industry executives in its semi-annual State of the VR Industry survey how important LBVRE to their company’s near-term success within the next twelve months. Roughly 36% rated LBVRE as an ‘important’ distribution strategy.

Furthermore, we found survey respondents that were working on VR games are more likely to say that LBVRE is ‘very important’ than those working on cinematic VR content.

Furthermore, we found survey respondents that were working on VR games are more likely to say that LBVRE is ‘very important’ than those working on cinematic VR content.

Based on Greenlight Insights March 2017 forecast, LBVRE is expected to grow in revenues to $1.2 billion in 2021, propelled by commercial and consumer spending on VR technology, content and services at cinemas, arcades, and other venue attractions.

Detailed developments and forecasts of the VR industry are covered extensively in the 2017 Virtual Reality Industry Report, co-authored by Greenlight Insights and Road to VR.